Market Trends to Watch in 2023

Here are some of the Trends that we believe will be important to monitor in 2023 and beyond. Davidson Investment Advisors puts this piece together annually; it is-meant to provide some insight into exciting, disruptive, or otherwise new developments we anticipate to be impactful to businesses, consumers, and society. You may notice that some of our discussions are follow-on and reference past years’ trend pieces. Perhaps that’s a good sign that we have indeed identified trends.

Supply Webs

Supply Webs

The COVID pandemic exposed the fragility of global supply chains – in particular, the reliance of some on China. We highlighted initial remedy reactions in China+1 (Trends 2021), but the trend has continued to evolve, invoking de-globalization and a shift from supply-chains to supply-webs. Gone are the days of lowest-cost manufacturer and just-in-time inventory; enter the days of reliable supply-chains and just-in-case inventory management. The implications are enormous… hundreds of billions of dollars in economic activity as supply-chains move and diversify – becoming a web, rather than a chain.

This trend will likely widen the gap between winners and losers. Trade can become more targeted and it can encourage economic diversity as well as stability over time. Domestic labor should be a winner, especially in developed countries that have relied heavily on low-cost Emerging Market labor, and this can be a real positive for overall living standards with more opportunity for those without specialized skills.

Cultured Meat

Cultured Meat

Previously, we highlighted a trend away from meat and protein made from animals in Where’s the beef? (Tends 2018). Certainly, we’ve witnessed a rise in plant-based protein which is already capturing a sizable amount of demand for alternative protein, pushed partially by millennials and a trend toward incorporating more vegetarian food into Western diets. However, cultured meat may be better positioned to disrupt the alternative protein market than plant-based. Cultured meat or “painless proteins” involves growing animal cells in bioreactors at high densities, using nutrient-rich growth medium. The animal cells are sourced from tissue biopsy, without having to slaughter the animal. The process may also been seen as safer and more sustainable, with respect to pathogen outbreaks (need for antibiotics), high levels of food waste, greenhouse gas emissions from livestock, and land use. Furthermore, a Barclays Consumer Survey of 5000 adults in August 2021 across five countries (China, India, Brazil, the US, the UK), indicates two-thirds of adults would consider purchasing cultured meat if it became available. We anticipate 2023 may be a breakout year for cultured meat, as the US FDA recently completed its first pre-market consultation, confirming the cultured chicken from UPSIDE Foods is safe to eat. Initial introductions will likely be in cultured chicken and cultured seafood, due to lower complexity compared to beef protein. Next steps before approval will also involve the USDA on inspection and labelling, but we expect to see more announcements about Cultured Meat in 2023 and beyond.

Water

Water

As a follow-on to Water Break (Trends 2020), we revisit the trend of water stress. In the US, cities and municipalities are expanding reservoirs or tapping into neighboring watersheds in order to navigate droughts and ensure future supplies. Entire states are negotiating or re-negotiating water sharing rights, whether it be over access to the Colorado River in the American Southwest, or literally, one state (Nebraska) actually seizing Colorado land to build canals to maintain agreed allotments to the South Platte River.

This issue is not just about growing crops and maintaining supplies of drinking water. Climate change continues to fuel longer, more severe droughts that are impacting navigation of waterways and production of energy. The Mississippi River system, critical for the transportation of grain, sand/gravel, and metals, has been rendered nearly inoperable at times this year due to record low water levels causing barge traffic to be halted and forcing farmers to use alternative (and more expensive) forms of transportation, such as rail. The Colorado River system’s two largest reservoirs, Lake Powell and Lake Mead, which provide water for energy production at Glen Canyon and Hoover Dams, respectively, are at the lowest levels ever recorded. In fact, should Lake Powell drop another 30 feet, electricity production will cease at the Glen Canyon Dam. Ironically, lower hydroelectricity production on the Colorado is causing utilities to use more fossil fuel to maintain service to customers.

Beyond the United States, this situation may even be worse. Whether it be lower hydroelectricity production in Europe, water contamination and shortages in China or severe droughts in parts of Africa, competition for water supplies may be leading to increased geopolitical conflicts, as evidenced already by the conflict between India and China over key watersheds in the Himalayas. The battle over water rights and efficient usage look to continue for years, and the implications of such remain unknown.

Unproductive People

Unproductive People

The US economy is currently at one of its lowest unemployment rates in history and has around ten million unfilled job positions according to the US Bureau of Labor Statistics; however, labor force participation rates remain historically low, and is at the lowest level ever recorded for prime-age males. Though perhaps exacerbated by the COVID pandemic, the trend was well-established prior to 2019 and may be associated with other trends such as Great Resignation (Trends 2022) and Playing with FIRE (Trends 2019). What gives? Perhaps Tyler Childers got it right in his song Whitehouse Road, “Get me higher than my grocery bill.” Whether it be loneliness, lack of job skills, substance abuse or a combination of all three, there is a significant portion of the US population that has gone from forgotten, to unproductive, to becoming a serious drain on public resources. According to the Association of American Medical Colleges, 21.2 million Americans have a substance abuse disorder. The US Department of Health and Human Services estimates that 760,000 Americans have died of drug overdoses since 1999 and 10.1 million Americans over the age of 12 misused opioids in 2019. Relatedly, the homeless issue in many large US cities is only getting worse despite the billions of dollars being spent. According to the Hoover Institute, San Francisco alone is spending $852 million in its current budget year on homeless and supportive housing for its estimated 8,000 homeless people. That equates to $106,500 per homeless individual-this in a city that spends roughly $19,500 annually per student in its public schools. It simply is not sustainable.

The US is facing a structural labor deficit despite a growing population, and those remaining in the workforce are not becoming more productive despite widespread use of technology. This lack of productivity appears more severe in the US, but it is a global issue. Whether it be work-from-anywhere (WFA Trends 2021), lying flat in China, or quiet quitting, the world needs to address this issue if it hopes for satisfactory economic growth going forward.

Digital Transformation 2.0

Digital Transformation 2.0

With Digital Transformation 1.0 (Trends 2020) well along and accelerated by COVID and Work From Anywhere (Trends 2021), companies have moved many of their basic workloads from on-premise to The Cloud (Trends 2011). What’s next? The first phase of digital transformation was connectivity, mobility, Big Data (Trends 2012), and automation technologies such as robotic process automation (RPA) that allow users to more easily configure software to perform actions or automate business processes. Digital Transformation 2.0 builds on this effort, but will be driven more by data and will move more intelligence and employee empowerment to the edge. While Digital Transformation may have automated workflow for efficiency, Digital Transformation 2.0 will provide insights to improve workflow for better outcomes and fine tune business process for optimal performance using data and machine learning tools as described in CAIS (Trends 2020) and ChatGPT (Trends 2022). Currently, information technology (IT) and business intelligence (BI) tools are manually driven, tedious, time-consuming, and subject to bias. Artificial and augmented intelligence can mitigate those challenges, analyzing data in near real time to test, verify, and improve performance.

ESG Backlash

ESG Backlash

According to Bloomberg data, as of December 2021, assets under management at global exchange-traded “sustainable” funds that publicly set environmental, social, and governance (ESG) investment objectives amounted to more than $2.7 trillion; 81% were in European based funds, and 13% in US-based funds. That said, there appears to be a growing resistance to the movement of ESG.

The concept of earning more while doing good sounds like a great idea; however, in finance and economics there is rarely, if ever, a free lunch. ESG strategies attempt to apply non-financial factors as part of their analysis. The challenge many of these strategies face from an investor standpoint is it can be very difficult to distinctly classify what is measurable in ESG, and then determine an appropriate monetary value or rating. There is often times a large degree of subjectivity and gray area in assigning how much or how little each of these issues should weigh into the overall investment consideration. For example, should an oil and gas producer be classified in or out of an ESG portfolio? Fossil fuel production produces significant carbon, and is viewed as bad for the environment. However, to transition the global economy to cleaner more renewable energy sources, the world will still need oil and gas for many years. Limiting investment into these companies creates less capital available for oil and gas production, higher prices, less energy security, potentially weaker economies and less capital ultimately for transition to renewable energy. As it relates to ESG, the answers are unclear, adding additional complexity to every investment decision.

Then there is a problem of accountability for investment managers and corporate managers. Previously, we wrote of Corporate Woke (Trends 2021) and the often debated view of Stakeholder vs. Shareholder Capitalism. When subjective non-financial criteria are entered into evaluating results for investment managers and corporate executives, the significant gray area and subjectivity can create ambiguous accountability. For example, a corporate executive might say, “I know we are underperforming our peers financially, but we have best-in-class ESG metrics, so we have been very successful.” An argument for shareholders, often lost in the debate, is recognition that shareholders are the only stakeholders that do not enjoy contractual claims against the company; a Board of Directors exists to provide oversight and protect shareholder financial interests.

While the debate of ESG and its influence over capital markets are likely to continue what is less controversial is the benefits of disclosure. More disclosure not less is generally positive for all investors. It’s what investors do and how they interpret that additional disclosure is what matters most.

Scampocalypse

Scampocalypse

Financial fraud has always been a mainstay of society and economics. The first case of documented financial fraud dates back to 300 B.C. when a Greek merchant took out a large insurance policy on a cargo shipment of corn. The shifty merchant hatched a plan to keep his cargo of corn, sink his empty ship and receive the insurance money. Unfortunately for the merchant, the plan failed and he drowned trying to escape his crew when they caught him in the act.

Financial fraud has continued to evolve with the economy and technology. The most notorious cases of corporate fraud in the previous generation were cases such as Worldcom, Enron and Bernie Madoff. Today, we have seen corporate fraud continue to evolve into cases such as WeWork, Theranos and most recently accusations of wide-spread fraud at cryptocurrency exchange FTX, which the Department of Justice referred to as the “fastest big corporate failure in American history.” While financial fraud is of course not new, what is alarming is that is getting much more costly.

According to the Federal Trade Commission, American consumers reported losing more than $5.8 billion to fraud in 2021, an increase of more than 70% from the prior year. Those figures don’t include reports of identity theft and other categories, so the actual number is undoubtedly higher. Part of the reason for this rapid increase in fraud is a result of not only fear and confusion as a result of the pandemic, but also imposter scams, which were the most prevalent form of fraud. Typically, scams in these categories cost victims $1,000 to $3,000.

An additional driver of financial fraud more recently has been how Digital Assets (Trends 2022) and technology has made it easy to move money quickly. Attackers are looking for the weakest link in the chain, and often times a bank’s authentication controls are not worth the effort, so they attack the password or the persons themselves. In the case of cryptocurrency, one of the strongest cases advocates make for its utility value are its decentralized structure and transparency created by the blockchain (DeTrust Trend 2022), however, to date those attributes have not protected investors from significant levels of fraud. The trends in financial fraud are likely to continue, given the lack of regulatory oversight in opaque areas such as cryptocurrency, global interconnectedness and the amount of personal information widely available on the internet that attackers can prey on.

The fraud cycle typically lags the financial cycle. As we are seeing the end of an era of zero interest rates and cheap money, more frauds are likely to be exposed. The timeless Warren Buffett quote still rings true, “A rising tide floats all boats… only when the tide goes out do you discover who’s been swimming naked.”

Bond Vigilantes

Bond Vigilantes

In the 1990’s, President Bill Clinton’s political adviser, James Carville, famously remarked, “I used to think that if there was reincarnation, I wanted to come back as the President or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” At that time (November 1994), US 10-year Treasury yields climbed from 5.2% to just over 8%, fueled by concerns about federal spending. This period, known as the Great Bond Massacre, was a clear example of bond vigilantes making their opinion known within financial markets.

The term “bond vigilante” was coined in the 1980’s by economist Ed Yardeni, which refers to a bond investor who threatens to sell, actually sells or avoids buying a large amount of bonds to protest or signal disagreement with policies of the issuer. Generally, this behavior results in higher borrowing costs for the issuer, be it a government or corporation; however, if enough investors disagree with the policy, this can result in sharply higher borrowing costs, forcing the entity into distress, change of policy or a higher rate of return that compensates the investor for the additional risk.

Many thought bond vigilantes had gone extinct as over the last decade, as we’ve seen mostly a period of zero-to-low interest rates and increased central bank intervention. However, it now appears the vigilantes had only been in hibernation mode, and inflation and higher interest rates have awakened them. The latest episode of bond vigilantism recently occurred in the United Kingdom, as then Prime Minister Liz Truss announced her economic plan. Bond investors saw the plan and foresaw the trouble it would inflict on an already tenuous economy, resulting in the 30-year UK Bond yield surging from just under 3.5% to nearly 5% in just a few days. This caused the Bank of England to intervene in the bond market, backstopping support as several pension and insurance companies came under considerable distress. As a result, Liz Truss’s reign as prime minister only lasted 45 days and forced the UK government to change its plan.

Are further bouts of bond vigilantism in our future? The originator of the term, Ed Yardeni, believes so, saying, “They’re Baaack!” as huge amounts of monetary and fiscal stimulus released during the pandemic has awakened these market forces. During the COVID pandemic, we wrote about Zombie Companies (Trends 2021), which described the unprecedented actions by the Federal Reserve; while necessary, it had the unintended consequence of keeping many near-dead companies from failing.

Zombie Companies beware! The living dead may not walk forever.

ChatGPT

ChatGPT

A prototype artificial intelligence chatbot (ChatGPT) developed by OpenAI and released on November 30, 2022, has captured the imagination of the public and has provided a glimpse of what’s to come. OpenAI (an artificial intelligence research lab also responsible for DALL-E2 which interprets natural language inputs to create images of realistic objects) counts among its founders tech luminaries Elon Musk and Sam Altman.

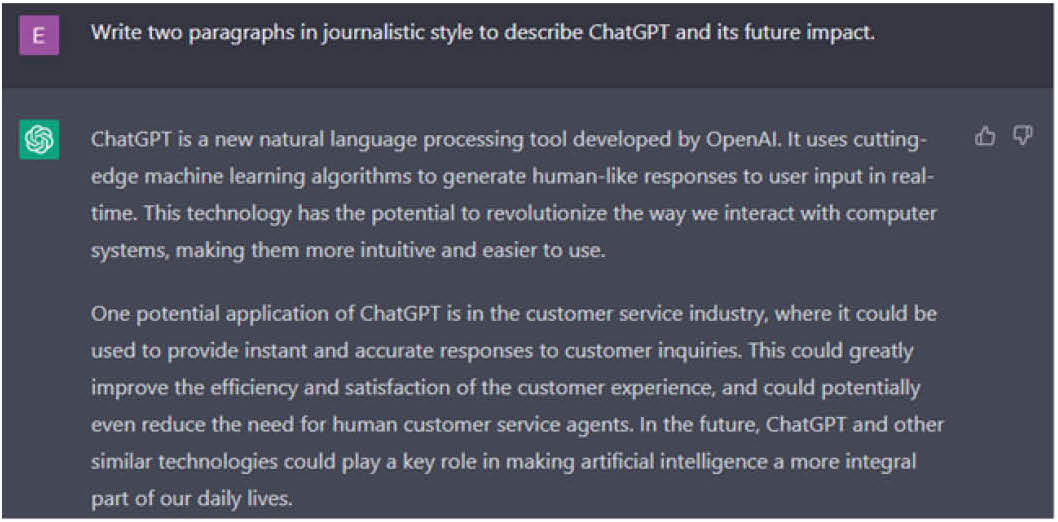

In CAIS (Trends 2020), we discussed advances in machine learning and introduced the concept of comprehensive AI services. It may have seemed like a distant scenario that would emerge over time, but ChatGPT appears to be a step change. Perhaps, we’ll let ChatGPT speak for itself. Below is ChatGPT’s response to the query, “Write two paragraphs in journalistic style to describe ChatGPT and its future impact”:

XR

XR

eXtended Reality (XR) is a catch-all term for technologies that enhance or replace our view of the world. This is often through overlaying or immersing computer text and graphics into real-world and virtual environments, or even a combination of both. XR encompasses augmented reality (AR), virtual reality (VR), and mixed reality (MR) – technologies we first introduced in Alternate Realities (Trends 2017). A central feature of all XR wearable devices is the ability to use visual input methods such as object, gesture, and gaze tracking to navigate the world and display context-sensitive information. However, XR devices vary based on the type of AR, VR, and MR experience and the complexity of use case that they are designed to enable.

Apple Inc.’s focus on AR/VR has ramped up over the past few years and will likely make the technology mainstream. As XR technology continues to advance, we expect it to play a crucial role in the development of the Metaverse (Trends 2022). This technology has the potential to revolutionize the way we interact with the digital world, blurring the lines between the physical and the virtual.

Future of Work

Future of Work

In their 2020 book, The Great Demographic Reversal, Charles Goodhart and Manoj Pradhan plead for more automation and a restructuring of the labor force toward more care-focused occupations. They argue that the aging of our society will be much more painful without the necessary number of people in care-focused work, and using robots to do such work is suboptimal as robots lack the compassion and empathy of a human. The current shortage of doctors and nurses we see throughout the United States is likely just the beginning of a shortage of care for our quickly aging society. While it is true that some portion of our society is unproductive, leading to a higher and rising dependency ratio, some prime-age males have left to workforce to become part of this care economy by caring for children and aging parents, which ultimately impacts the economy’s ability to grow.

That is where robots enter the equation, as they will be needed in ever-growing numbers to support economic growth going forward. Humans and machines could be spending equal amounts of time completing work tasks by 2025, with the global robot installed base expected to grow significantly. While companies are developing humanoid robots today, their widespread practical application in production settings is likely a few years away. For the time being, “cobots,” collaboration between a human and an industrial robot, are more likely to be used to complete tasks more efficiently, and in fact, is one of the fastest growing areas in robot adoption. Recently, Amazon demonstrated a robot called Sparrow, which has an arm that features seven rubber-tipped, vacuum-powered suction devices that extend or retract depending on the size, shape and orientation of the product being grasped. Its current use case is more akin to a “cobot,” as it negates the need for workers to complete injury-prone parts of tasks, but it could eventually fully replace the workers it currently helps. This would ultimately lead to more availability of humans to provide care in our aging society. So when you hear reports about robots replacing workers, remember that without them, our elderly may find themselves without anyone to care for them.

Disclosures: Davidson Investment Advisors is a SEC registered investment advisor. The opinions expressed herein are those of Davidson Investment Advisors and are subject to change. The information contained in this presentation has been taken from trade and statistical services and other sources, which we believe to be reliable. We do not guarantee that this information is accurate or complete and it should not be relied upon as such. This presentation is for informational and illustrative purposes only, and is not intended to meet the objectives or requirements of any specific individual or account. Past performance is not an indicator of future results. Indices provide a general source of information on how various market segments and types of investments have performed in the past. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. Icons made by Freepik, Bert Flint, and Smalllikeartfrom www.flaticon.com