FIRST QUARTER 2023 INVESTMENT COMMENTARY

MARKET RECAP

Despite the stress in the banking system, including the failure of Silicon Valley Bank, global equity markets held up remarkably well in March and posted solid returns for the quarter. The S&P 500 index was up 3.7% in March and gained 7.5% in the first quarter. Developed international stocks (MSCI EAFE Index) did a bit better, rising 8.5% for the quarter (and returned 2.5% in March). Emerging markets stocks (MSCI EM Index) gained 4% for the quarter and rose 3% in March.

Underneath the calm market surface, there was wide dispersion in returns across sectors, market caps and styles. Large-cap growth stocks (Russell 1000 Growth Index) gained 14.4% in the quarter, while the large-cap value stocks returned 1% (Russell 1000 Value Index). The Nasdaq Composite Index surged 17%, while the Russell 2000 Small Cap Value Index dropped 0.7%.

Fixed-income markets had a strong quarter as longer-term bond yields fell, generating price gains. Core investment-grade bonds (Bloomberg U.S. Aggregate Bond Index) returned 3%, as the 10-year Treasury yield fell to 3.5% from 3.9% at year-end. Riskier high-yield bonds (ICE BofA U.S. High Yield Index) outperformed core bonds gaining 3.7%. Municipal bonds gained 2.3% (Morningstar National Muni Bond Category). Flexible/nontraditional bond funds gained around 3%.

INVESTMENT OUTLOOK AND PORTFOLIO POSITIONING

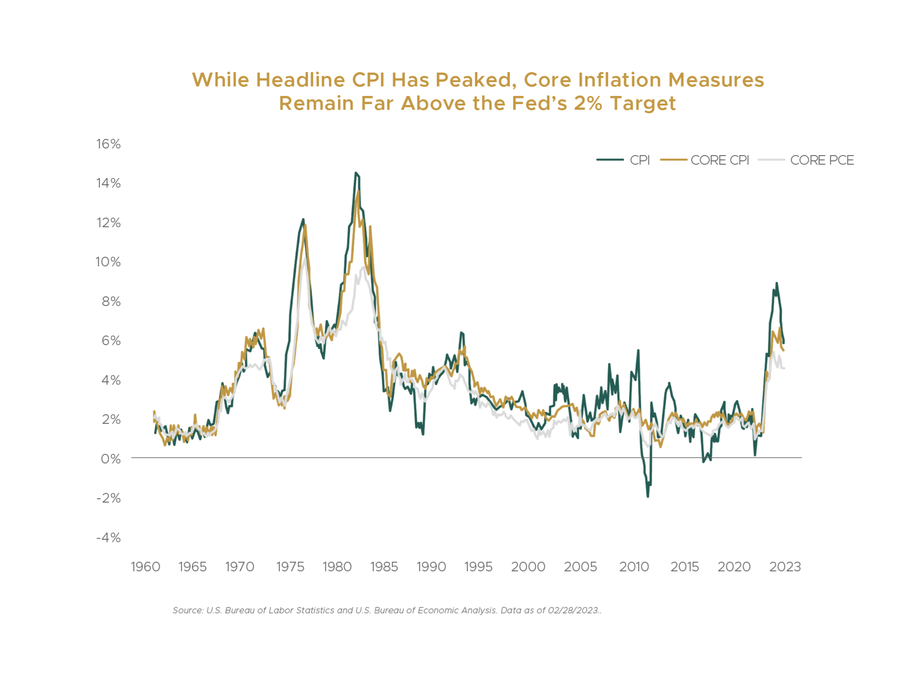

With above-normal inflation and the Fed sharply tightening, the short-term outlook for economic growth was already poor coming into 2023. Add to that the negative impact from tighter credit conditions due to recent stress in the banking system (i.e., Silicon Valley Bank, Signature Bank, etc.), and the growth outlook has continued to weaken. A U.S. recession this year is not a certainty, but weighing the evidence as we see it, we believe recession is still the most likely outcome.

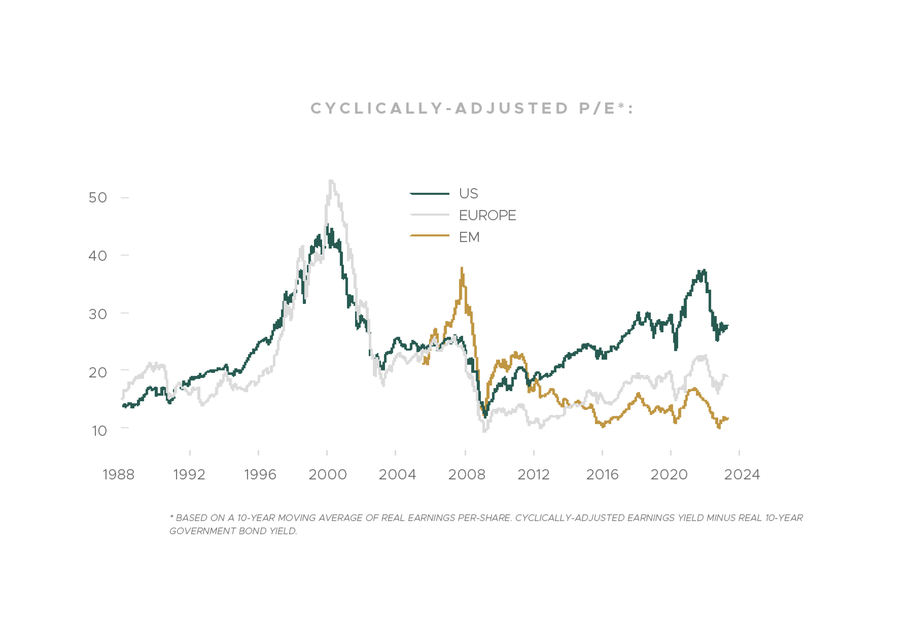

In an economic recession, it is almost certain corporate earnings will decline. S&P 500 index earnings typically decline around 15% to 20% (peak-to-trough) during economic recessions as both sales growth and profit margins compress. In a mild recession, the earnings decline might be closer to 10% to 15%. Yet, the current consensus earnings expectations for 2023 do not reflect nearly that magnitude of decline; nor do current stock market valuations. In other words, we do not believe U.S. stocks are adequately discounting the likelihood and severity of an oncoming economic and earnings recession. If our base case earnings recession scenario plays out, there is a strong likelihood that the S&P 500 index will decline from current levels.

Longer-term, looking out over the next several years, our expected returns for U.S. stocks are in the mid-single digits over the period, which assumes a recessionary bear market happens. This is a decent, but not great expected return for U.S. stocks given their risks. It is also well below our five-year return expectations for developed international and emerging markets, which are in the high single to low double digit annual average returns.

INVESTMENT OUTLOOK AND PORTFOLIO POSITIONING

With above-normal inflation and the Fed sharply tightening, the short-term outlook for economic growth was already poor coming into 2023. Add to that the negative impact from tighter credit conditions due to recent stress in the banking system (i.e., Silicon Valley Bank, Signature Bank, etc.), and the growth outlook has continued to weaken. A U.S. recession this year is not a certainty, but weighing the evidence as we see it, we believe recession is still the most likely outcome.

In an economic recession, it is almost certain corporate earnings will decline. S&P 500 index earnings typically decline around 15% to 20% (peak-to-trough) during economic recessions as both sales growth and profit margins compress. In a mild recession, the earnings decline might be closer to 10% to 15%. Yet, the current consensus earnings expectations for 2023 do not reflect nearly that magnitude of decline; nor do current stock market valuations. In other words, we do not believe U.S. stocks are adequately discounting the likelihood and severity of an oncoming economic and earnings recession. If our base case earnings recession scenario plays out, there is a strong likelihood that the S&P 500 index will decline from current levels.

Longer-term, looking out over the next several years, our expected returns for U.S. stocks are in the mid-single digits over the period, which assumes a recessionary bear market happens. This is a decent, but not great expected return for U.S. stocks given their risks. It is also well below our five-year return expectations for developed international and emerging markets, which are in the high single to low double digit annual average returns.

Among the three regions, we tactically favor EM stocks right now based on their higher expected returns, which are a function of what we expect will be faster sales growth and improving profit margins over the next several years. This comes after more than 10 years of stagnant EM earnings growth. We also expect some narrowing of the historically large valuation discount between EM and U.S. indexes.

Finally, we expect the U.S. dollar to decline versus most other currencies over the medium term, which would further add to EM and international equity returns for dollar-based (unhedged) investors. When the U.S. stock market declines to levels that offer more compelling medium-term returns and adequately discount shorter-term risks, we will look to add back exposure by selling more defensive assets (bonds).

In addition to our core bond exposure, we continue to have a meaningful allocation to higher-yielding, actively managed, flexible bond funds run by experienced teams with broad investment opportunity sets. There are many fixed-income sectors outside of traditional core bonds that offer attractive risk-return potential, and we want to access them via our active managers.

CLOSING THOUGHTS

We believe 2023 will present us with some excellent long-term investment opportunities. Unfortunately, in our base case we also expect we’ll first have to go through a recessionary bear market with a likely meaningful drop in global equity prices. While a recessionary bear market is our base case, we do not rule out the possibility the U.S. economy avoids recession this year, or that the recession is mild, and stocks do not drop as sharply as we expect.

A lot still depends on the Fed and how much further they tighten (raise rates). If the Fed pauses their hiking campaign sooner than later, equities may positively respond (at least over the short term), as lower interest rates imply higher P/E multiples. But there are numerous other key variables for the economy and financial markets that are beyond the Fed’s or any policymaker’s control. The recession may be pushed out to 2024, but we doubt it’s been rescinded.

Even with a recession as our base case near-term scenario, we currently see attractive medium-term expected returns from international and emerging markets stocks – better than what we expect from the U.S. market. As such, we have a relative overweighting to equities outside the U.S.

Fixed-income assets and high-quality bonds are also now attractively priced with mid-single digit or better expected returns, depending on duration and credit quality. Core bonds will also provide valuable portfolio ballast in the event of a recessionary bear market.

As always, we thank you for your trust and welcome questions you may have.

Best regards,

-The Owen Legacy Group

Note: For discretionary use by investment professionals. This document is provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.