Second Quarter 2020 Investment Commentary

2020 Q2 Edition

For most of the second quarter, financial markets seemed to defy grim economic news, the continued spread of COVID-19, and worldwide protests against racial inequality. Global equities performed strongly for the quarter and rewarded investors who remained invested. From the March 23 low, the U.S. equity market soared 40%, recording its best return ever over any 50-day period.

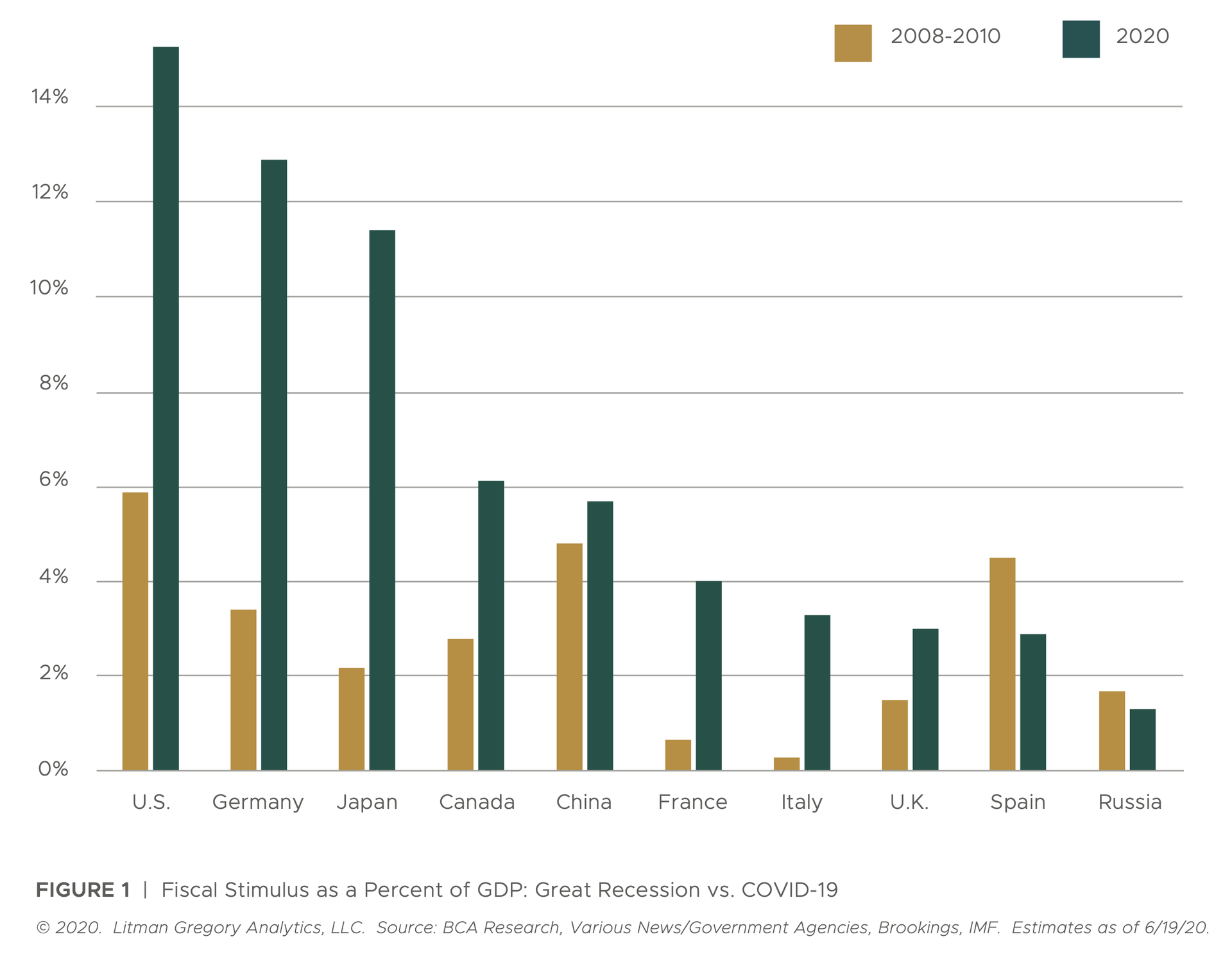

Enormous levels of money printing and government spending certainly helped the investor mood. Central banks around the world provided unprecedented support to markets and economies. On the fiscal side in the United States, trillions in direct payments and loans have been, or are going to be, delivered to impacted citizens and businesses. The level of stimulus globally already surpasses by far what was issued during the 2008 financial crisis.

Second Quarter Market Recap

In the second quarter, larger-cap U.S. stocks gained 21% and smaller-cap stocks climbed 25%. Despite the medical, economic, and social turmoil all around, the U.S. market is down just 3% year to date (as of June 30) and only 8% below its all-time high on February 19.

However, there is a distinct style (or factor) bifurcation beneath the surface: The Russell 1000 Growth Index is up 10% on the year, while its Value sibling is down 16%. That is a stunning 26 percentage point difference. Or, from another angle, the S&P 500 technology sector is up 12% on the year, while the financials, industrials, and energy sectors are down 24%, 14%, and 35%, respectively.

Looking overseas, developed international stocks rose 17% and EM stocks gained 19% in the second quarter. For the year, they are down 11% and 10%, respectively. As in the United States, growth indexes are meaningfully outperforming value indexes overseas. The U.S. dollar depreciated slightly during the quarter, providing a modest tailwind to foreign market returns for dollar-based (unhedged) investors such as ourselves.

Finally, in the fixed-income markets, core bonds gained almost 3% for the quarter, as Treasury yields dropped slightly (falling bond yields imply rising bond prices) and investment-grade corporate bond spreads narrowed, rallying along with the equity markets. Riskier credit-sensitive sectors within the fixed-income universe posted very strong gains, making up ground from their first quarter losses. Floating-rate loans and high- yield bonds gained nearly 10%, leaving them around 5% underwater for the year.

Second Quarter Portfolio Performance & Key Performance Drivers

The incredible rebound in risk-asset markets—stocks, corporate bonds, and other credit markets—in the second quarter provided a strong tailwind for our portfolios.

As a reminder, in early April after the S&P 500 plunged 25%, we rebalanced back to U.S. stocks in all portfolios, funded from lower-risk assets. We do not rule out the possibility U.S. stocks will revisit their March lows (2,237 on the S&P 500) and are ready to act again if a compelling opportunity arises.

In the meantime, we are comfortable with current portfolio positioning, which balances a variety of shorter-term risks against attractive medium- to longer-term return opportunities, across a range of macroeconomic scenarios and potential market outcomes.

We continue to expect superior returns from international and EM stocks over our five-year tactical time horizon. First, overseas stocks are more reasonably priced. For example, EM stocks’ cyclically adjusted P/E ratio is near its lowest point in 35 years of data. Second, foreign economies and their markets are generally more sensitive to global growth, so as the world recovers from the pandemic, foreign stock prices should outperform U.S. stocks. Finally, in a sustainable recovery, we would expect the U.S. dollar to decline, as it is generally a safe-haven currency that depreciates in the face of strong global growth. A falling dollar would further enhance foreign stock returns for U.S. dollar- based investors (as foreign earnings are translated into more dollars).

Our portfolios’ fixed-income exposure remains well-diversified, including core investment- grade bond funds (providing recessionary/bear-market ballast to the portfolio) and flexible, actively managed credit- and income-oriented funds, including a tactical position in floating-rate loans in some portfolios. All these non-core fixed-income sectors meaningfully outperformed the core bond index, enhancing our portfolios’ absolute and relative performance for the quarter.

Finally, in aggregate (and with only a few exceptions), our active equity and fixed-income managers outperformed their respective benchmarks for the quarter — another reversal compared to their relative performance in the first quarter.

Closing Thoughts

So where does this leave us? The successful containment of COVID-19 is not a foregone conclusion. The resurgence of cases in the southern and western United States, not to mention in several EM countries like Brazil and India, is concerning. Local U.S. authorities have so far refrained from large-scale rollbacks of their reopening efforts. But if strict widespread lockdowns return, the global economic recovery will be more drawn out, which would be a negative surprise for markets. There are also other uncertainties around the November election or the ongoing U.S.-China dispute that could disrupt financial markets.

We hold a cautiously optimistic view that with the recent uptick in COVID-19 cases, the overall social policy response won’t need to be as draconian. Therefore, the economic impact should be less extreme than during the first wave. If a more benign public health scenario plays out against a backdrop of extremely loose fiscal and monetary policy, there is a good chance we’ll get a sustainable global economic recovery. It’s unlikely to be a sharp V-shaped recovery, but something more gradual, with fits and starts along the way and with some sectors and industries doing much better than others. If so, corporate earnings are likely to rebound as well.

Despite our cautious optimism, this is still the time for us to continue shoring up your overall financial situation so you can confidently weather any dark times that may lie ahead. We can help you determine or evaluate an appropriate emergency fund, revisit your cash flow projections to ensure you remain on a sustainable path.

We can help you take advantage of various provisions of the SECURE and CARES Acts. New rules for RMDs and Roth conversions may fit into your plan; we are here to guide you through any of these planning opportunities.

It is also important to find an outlet for the stress and fear we are all feeling. Taking breaks from the daily news cycle and focusing on the physical and mental health of you and your loved ones will go a long way. We need to have the mental strength to keep a long-term perspective when investing so we can stick to our investment plan. This starts with being invested in the right portfolio that’s aligned with your risk tolerance and financial goals.

If you have any concerns, we are here to help you re-evaluate your portfolio for the long term.

In the face of an uncertain future, we try to remember that, through history, nothing — not even world wars and pandemics worse than the current one — stopped the inexorable rise of markets, economic growth, and progress toward greater equality and freedom, however slow or challenged it may have felt at any particular moment. As a society, we will make it through the crises we face today and come out stronger and more resilient than ever.

As always, it is paramount that our investment management be guided by a strategy that meets the risk/return profile of the clients we serve. And we need to keep a long-term perspective with an eye on near-term risks so that we remain disciplined through the inevitable downdrafts when fear in the markets is palpable.

–The Owen Legacy Group

The Owen Legacy Group is available to discuss the ideas, strategies, products, and services described herein, as well as the suitability and risks associated with them. D.A. Davidson & Co. does not provide tax or legal advice. Questions about the legal or tax implications of any of the products or concepts described should be directed to your accountant and/or attorney. D.A. Davidson & Co. is a full-service investment firm, member FINRA and SIPC.