Fourth Quarter 2019 Investment Commentary

2019 Q4 Edition

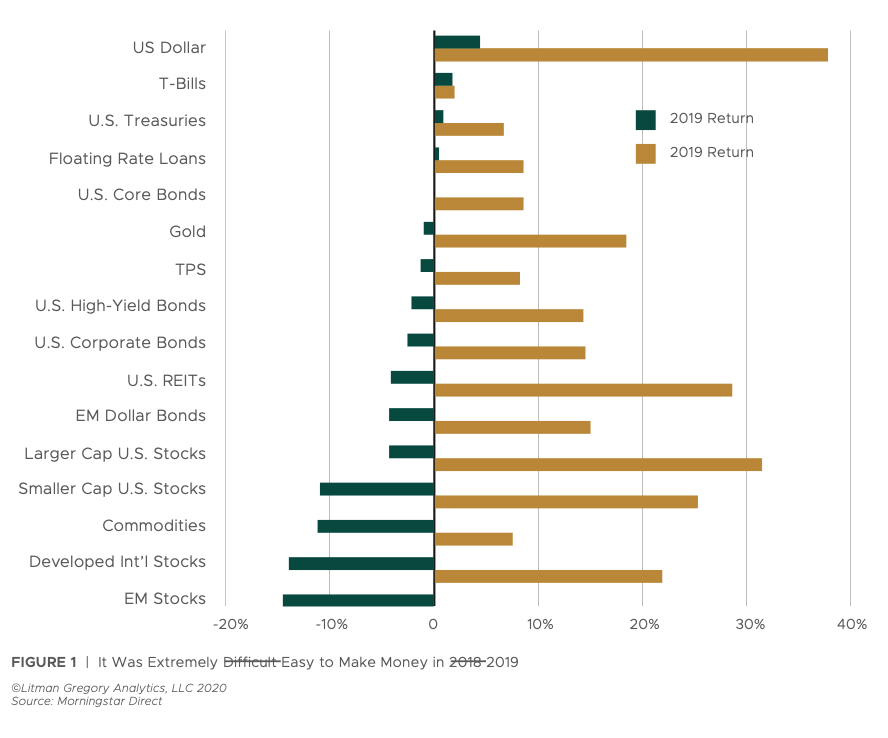

Among global equity markets, larger-cap U.S. stocks were once again at the top of the leader board. The S&P 500 Index posted gains in every quarter and surged 9% in the fourth quarter to end the year at an all-time high. Its 31% total return was its second-best year since 1997. (It was up 32% in 2013.) Smaller-cap U.S. stocks rose 25.4% for the year.

Foreign equity markets were also strong. European stocks gained 9.9% in the fourth quarter and 24.9% for the year. After struggling in the third quarter, emerging-market (EM) stocks shot up almost 12% in the fourth quarter and returned 20.8% for the year.

The core bond index was flat in the fourth quarter but gained 8.6% for the year. This was its best annual return since 2002. Below-investment-grade bonds also fared well in 2019. High-yield bonds gained 14.4% and the floating-rate loan index rose more than 8.6%.

Why did both stocks (risky assets) and bonds (defensive assets) appreciate sharply in 2019? The key driver was the Federal Reserve’s sharp U-turn toward accommodative monetary policy. This was followed by other central banks across the globe. Coming into 2019, the Fed was indicating it expected to continue to raise interest rates. This led investors to fear that higher rates could tip the U.S. and global economies into recession, bringing an equity bear market with it. The ongoing U.S.-China trade conflict didn’t help matters.

Ultimately, the Fed ended up cutting rates three times in the second half of 2019. Late in the year, it also started expanding its balance sheet again via purchases of Treasury Bills in order to boost banking system reserves and inject liquidity into the short-term lending markets. Other major central banks also cut rates and/or provided additional stimulus to the markets during the year. This lessened recession fears.

Meanwhile, inflation (and inflation expectations) remained at or below central bank targets. This lifted concerns that interest rates would be hiked anytime soon, and the bond market rallied.

U.S. equity investors responded to the Fed policy reversal and stimulus much as they have during the past 10 years—by bidding up stock prices and valuations. A de´tente in the U.S.-China trade war late in the year (the “phase one” deal) was an added boost to market sentiment. Importantly, earnings growth did not drive U.S. stocks higher; the majority of the S&P 500’s return came from expanding valuations. Thus, the valuation risk in U.S. stocks, which we’ve highlighted for some time now, has only gotten worse.

There are reasons to be cautiously optimistic for financial markets in 2020: Monetary policy is easy, recession risks seem to be receding, and some geopolitical risks have abated. That said, we are watching a number of potential short-term risks. Given we think recent positive developments have largely been incorporated into prices and valuations are stretched for U.S. stocks and bonds, markets are particularly vulnerable to any disappointment or negative surprise. If that comes to pass, we stand ready to take advantage of any potential opportunities that come of that volatility.

Market and Performance Recap

Our portfolios generated strong returns for 2019, a bullish year for nearly all financial markets. The positive broad-based returns marked a dramatic (and welcome) turnaround from 2018, a year in which nearly all asset classes faltered.

This year’s surprising returns were fueled by a U-turn in monetary policy, as policymakers shifted gears to support a weakening global economy. After tightening financial conditions (raising short-term rates) four times in 2018, the Federal Reserve reversed course and began implementing a more dovish monetary policy (lowering short-term rates three times). Other major central banks also cut rates or provided additional stimulus to the markets via quantitative easing during the year, lessening global recession fears.

U.S. stocks rose in every quarter and surged an additional 9% in the fourth quarter as the United States reached a tentative “phase one” trade agreement with China. The S&P 500 Index’s 31% total return was its second-best year since 1997. (Bested only by 2013’s 32% gain.) Smaller-cap U.S. stocks rose 25.4% for the year.

Foreign markets were also strong. European stocks gained 9.9% in the fourth quarter and 24.9% for the year. After a weak third quarter, emerging-market (EM) stocks shot up nearly 12% in the fourth quarter and returned 20.8% for the year.

The 10-year Treasury yield dropped from 2.70% at the start of the year to as low as 1.45% in September, ending the year at 1.92%. Investment-grade bonds gained nearly 9%. Credit markets also rallied amid this supportive monetary policy environment: high-yield bonds earned 14.4% and the floating-rate loan index rose 8.6%.

What's Next for 2020

After a year like 2019, the obvious question looking ahead is how much higher can equities go? For many years, assets have been flowing into U.S. stocks on the back of a strong U.S. dollar and the United States’ perceived safe-haven status relative to other global economies. In this respect, 2019 was largely an exclamation point on the decade’s investment pattern.

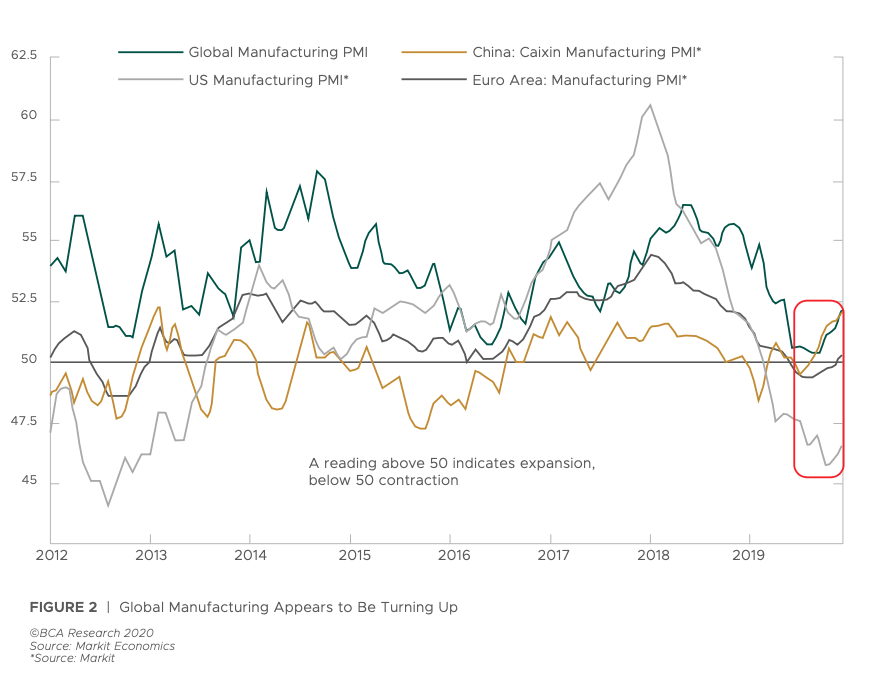

As we look ahead in 2020, there are reasons to be cautiously optimistic for financial markets. Accommodative central bank monetary policy and easier financial conditions should continue to support at least a modest rebound in global economic growth. As just one point of reference, the Global Manufacturing Purchasing Managers’ Index (PMI) has risen for four consecutive months and inched into expansion territory (above 50) in November. Along with reduced U.S.-China trade risk, this suggests the global economy may be on the rebound. The U.S. consumer also remains in good shape as ongoing labor market strength, wage growth, and low interest rates should continue to support consumer spending and the housing market.

However, this modestly positive outlook is consistent with the consensus view, meaning that financial markets have already responded positively to these developments. The risk of an unpleasant market surprise or deterioration in the macro environment in 2020 shouldn’t be ignored.

A critical question for fundamental investors like us is always, “What’s in the price?” In this regard, we note that it wasn’t corporate profit growth that drove U.S. stocks higher in 2019. Reported earnings for the S&P 500 were actually flat over the first three quarters, and mid- single-digit percentage growth is projected for the fourth quarter. The lion’s share (roughly two-thirds) of the S&P 500’s 31% return came from a sharp expansion in valuations. We believe such stretched valuations leave U.S. stocks particularly vulnerable to disappointment or negative surprises in the macro environment.

Despite recent positive developments, the U.S.-China trade war could reignite or a different area of geo-economic conflict between the two countries could escalate. This would hurt a still-weak manufacturing sector and impact capital spending and business confidence (CEO confidence is already at recessionary levels).

U.S. election uncertainty, inflation surprises, and Brexit are also among the myriad risks that could impact markets over the coming months. Geopolitical risk is also, as always, a major unknown that we factor into our portfolio downside stress-testing. As of this writing in early January, global tensions are extremely high following the unexpected killing of Iran’s military commander by U.S. forces and now Iran’s retaliatory missile strike. While it is far too early to know how this will play out on a broad scale, equity markets have largely taken this in stride.

Portfolio Positioning and Outlook

While we watch and weigh the ramifications of short-term risks, it’s important to reiterate that we don’t invest based on 12-month market forecasts. The uncertainty is too high and the unknowns too many. More important and most relevant for our investment process is our outlook for the next several years, not months. In this respect, our assessment of the risks and opportunities remains consistent with what it’s been in recent years.

With U.S. stocks expensive and high risk, we continue to see better investment opportunities elsewhere: in foreign stocks and flexible bond funds.

Should the positive global growth outlook for 2020 play out, we’d expect foreign stocks to outperform U.S. stocks, given their higher cyclicality and sensitivity to overall GDP growth. Receding Brexit uncertainty should also help prop up European markets, in particular. Furthermore, to the extent the U.S. dollar weakens in this environment—due to it being a counter-cyclical currency—that will help foreign stock returns (for dollar-based investors).

Our tactical exposure to flexible bond funds run by skilled managers are particularly attractive in this environment given their ability to actively manage their portfolio risk exposures (e.g., dialing down risk when the reward is not commensurate) and take advantage of market inefficiencies and opportunities when they appear. Not only does this strategy provide valuable portfolio diversification, but we also expect this to deliver better medium-term returns than a traditional mix of U.S. stocks and core investment-grade bonds.

Given this backdrop—weighing the shorter- and medium-term risks and return opportunities and considering the economic fundamentals versus financial market valuations—we think the wisest course for balanced investors continues to be a broadly diversified, moderately defensive posture.

As always, we appreciate your confidence and trust in us. We wish everyone a happy, healthy, and peaceful New Year.

–The Owen Legacy Group

The Market Commentary & Portfolio Strategy is mailed quarterly to our clients and friends to share some of our more interesting views. Certain material in this work is proprietary to and copyrighted by Litman/Gregory Analytics and is used by Owen Legacy Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.