Third Quarter 2020 Investment Commentary

2020 Q3 Edition

Third Quarter Market Recap

Despite some choppiness in September, equity investors were treated to solid gains during the third quarter. The S&P 500 Index rose 8.9% in the quarter and has recovered all its losses for the year. Underneath the surface, mega-cap growth names continue to lead the U.S. market. Without the astonishing 42.5% year-to-date price return of the six so-called FANMAG stocks (Facebook, Amazon.com, Netflix, Microsoft, Apple, and Google/Alphabet), the S&P 500 would still be down for the year.

The outperformance of these top names means they now dominate the index. Market concentration is not unusual, but with the top 10 stocks in the S&P 500 making up 28% of the index, it’s extreme today. The important investment takeaway is to not be lured into chasing the returns of what has worked well in the recent past. These companies’ outsized past returns have come from their ascension to the top, not from owning them once they were already there. Owning the largest stocks has badly lagged owning the diversified index over time.

Nevertheless, this U.S. mega-cap growth effect is driving the outperformance of U.S. stocks versus foreign stocks this year. Developed international stocks gained 6.0% this quarter, almost three percentage points behind U.S. stocks, though, emerging-market stocks outperformed U.S. stocks with a return of 10.2%. Both groups still trail U.S. stocks year to date.

Some of this relative performance is deserved. Unlike in the dot-com era, today’s large U.S. growth firms have created real economic value. This has come at a time when growth has been scarce and interest rates low, so investors have been willing to pay up for their growth. That said, a durable economic recovery taking hold could be the catalyst for investors to turn away from these highflyers and favor undervalued stocks in out-of-favor industries and overseas markets.

Bond markets were calm throughout the summer, thanks in large part to the Federal Reserve’s extremely accommodative monetary policy. Treasury yields were unchanged, and core investment-grade bonds gained 0.6% in the third quarter. Fed officials say they are now targeting “average inflation” of 2% and have signaled that they do not expect to raise rates at least through the end of 2023. Since inflation has not topped the Fed’s target in a decade, many market participants expect low rates and supportive policy to continue for a long time. In riskier segments of the bond market, high-yield bonds and floating-rate loans were each up over 4% but remain slightly negative for the year.

Going into the final quarter of 2020, multiple crosscurrents and uncertainties are presenting both investment opportunities and risks, over the near term and medium to longer term. A unique U.S. election approaches in November. The market doesn’t like uncertainty, so the weeks leading up to the election and afterward may be volatile. But history shows any election-year declines are usually short-lived and the political party in power is not a significant driver of investment returns. Political views have no place in our investment process, and we don’t attempt to predict the short-term market reaction to elections (or any short-term event).

There are simply too many other factors that impact markets over time. Instead, we stick to our longer-term analytical framework in which we consider and weigh multiple macro scenarios and assess the potential risks and returns for numerous asset classes and investments in each scenario. The fundamentals are what really drive long-term market performance.

Looking through the election, there are reasons to be cautiously optimistic about the investment prospects for global equities and corporate bonds. And there are reasons for caution.

Reasons for Optimism

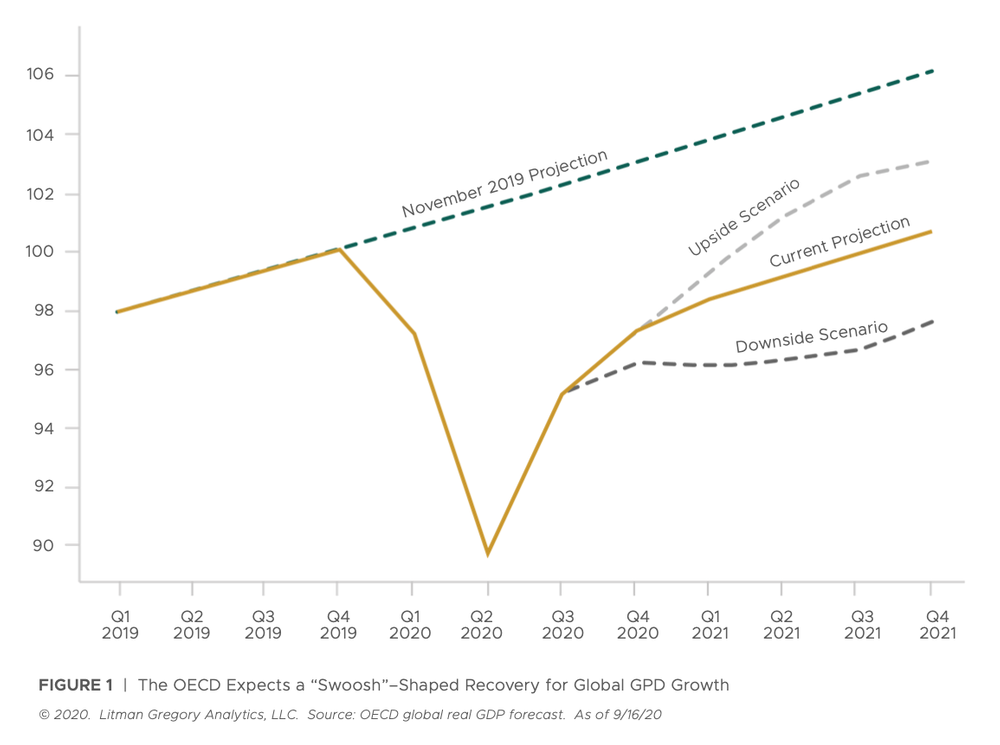

An economic recovery is underway. Economic data and forecasts are improving (see the growth projections from the Organisation for Economic Co-operation and Development [OECD] in the chart below). All else equal, rebounding economic growth here and abroad should support equity and corporate bond markets.

On the virus front, the speed of progress in vaccine development is promising. An effective and widely distributed vaccine would allow economic activity to return to its full pre-pandemic potential.

And this year’s extraordinarily supportive monetary policy (asset purchases and lower interest rates) and huge fiscal stimulus, both here and abroad, were key drivers of the speedy recovery in markets and the global economy. Central bank actions and government spending don’t guarantee the absence of volatility, another bear market, or recession. But there are programs now in place, especially in the United States, that could step in to help the functioning of markets and the economy in case volatility returns or setbacks occur.

Reasons for Caution

It remains to be seen how strong the actual economic recovery is and how much of it is already discounted in current prices. In our view, there is as much room for disappointments as there is for positive surprises.

While vaccine development steams ahead, the potential remains for a large resurgence of COVID-19 in the fall and winter months. We are seeing this already in Europe, and the infection rate has popped up slightly here in the United States recently. This raises the risk of renewed shutdowns and another economic downturn.

Monetary policy is supportive, but more fiscal support from Congress is likely needed to further protect citizens, help businesses survive, and shore up state finances. If it doesn’t happen, it will be a hit to fourth quarter economic growth, which could in turn impact markets.

Finally, there is always the potential for a negative geopolitical shock. The U.S.-China conflict and Brexit come to mind, but a new development could emerge that no one is considering (like the pandemic did earlier this year).

Portfolio Positioning

We are very comfortable with how our portfolios are constructed, as detailed below. The watchwords of our current positioning remain balance and resilience. Our portfolios are balanced across multiple dimensions: domestic versus international stock exposure, growth versus value strategies, interest rate risk versus credit risk. And we’ve designed our portfolios with the goal of generating potentially strong returns in our base-case and more optimistic economic scenarios, while maintaining resilience in a more challenging scenario.

On the equity side of our portfolios, as a reminder, we were underweight to U.S. stocks and stocks in general going into the pandemic due to unattractive valuations. In March after an initial large decline, we added to U.S. equity exposure at more attractive prices. Since that time, U.S. stocks have appreciated strongly, outperforming most other investments. They have soared more than 50% from the March low and again look historically overvalued. Forward price-to-earnings (P/E) and median P/E ratios are approaching dot-com-bubble highs. Nothing prevents valuations from rising even further near term, but we know high starting point valuations have a strong inverse relationship with future long-term returns. Overvaluation tends to not matter ... until it does.

But while U.S. stock valuations look expensive relative to history, they look cheap relative to bonds. Bond yields are extremely low, which forces investors to allocate more to stocks, pushing stock valuations even higher or keeping them higher for longer. Cheap relative valuations, in addition to a supportive Fed and plausible optimistic scenarios in which U.S. stocks can deliver decent returns, keep us from a larger underweight. We don’t want to be too underweight to U.S. stocks as there could be a significant opportunity cost if they continue to perform well.

On the fixed-income side, core bonds are an important shock absorber in a negative economic or geopolitical shock. However, as mentioned before, yields are very low and even a modest increase in interest rates could lead to negative short-term returns. To better diversify our fixed-income allocations, we have invested in actively managed flexible bond strategies with higher expected returns and lower interest rate risk. The tradeoff is they will not hold up as well as core bonds in a deflationary event. But we have taken this into account when setting your portfolios’ total equity risk, hence the slight underweight to stocks.

Closing Thoughts

History shows markets are consistently unpredictable. Adding to the uncertainty are the unprecedented circumstances, challenges, and structural changes the global economy is currently facing.

Having a high degree of conviction in any single outcome strikes us as imprudent. Instead of trying to continuously predict the future, we are focused on building resilient portfolios across multiple plausible scenarios, accounting for a range of shorter-term risks but keeping our primary focus on the medium- to longer-term fundamentals that ultimately drive investment returns.

Investing this way requires discipline, patience, and a willingness to stand away from the herd at times. It can feel uncomfortable to stay the course, put capital at risk when markets are plunging, or refrain from chasing overvalued markets higher when they are soaring. But in the end, this is the best approach we’ve found to achieve long-term investment goals.

–The Owen Legacy Group

The Market Commentary & Portfolio Strategy is mailed quarterly to our clients and friends to share some of our more interesting views. Certain material in this work is proprietary to and copyrighted by Litman/Gregory Analytics and is used by Owen Legacy Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.