Volatility is Not a Four Letter Word

2019 Q3 Feature

I think we are all glad to see the 3rd quarter of 2019 in the rearview mirror. If you turned on the news at any point this summer, odds are you wish you had walked out the door and onto a quiet trail instead. Even though Q3 ended the best consecutive three quarters since 1997, it didn’t feel that way for many. We did not have the quiet summer in the markets that many of us have come to expect, and the increased volatility, if nothing else, may have you wondering things like: What does volatility in the markets mean and why is it so nerve-racking? Why does it sometimes feel like I am missing big market growth in my diversified portfolio? How do I make sense of all that is being said in the media? And, what is actually affecting me?

Why Diversify?

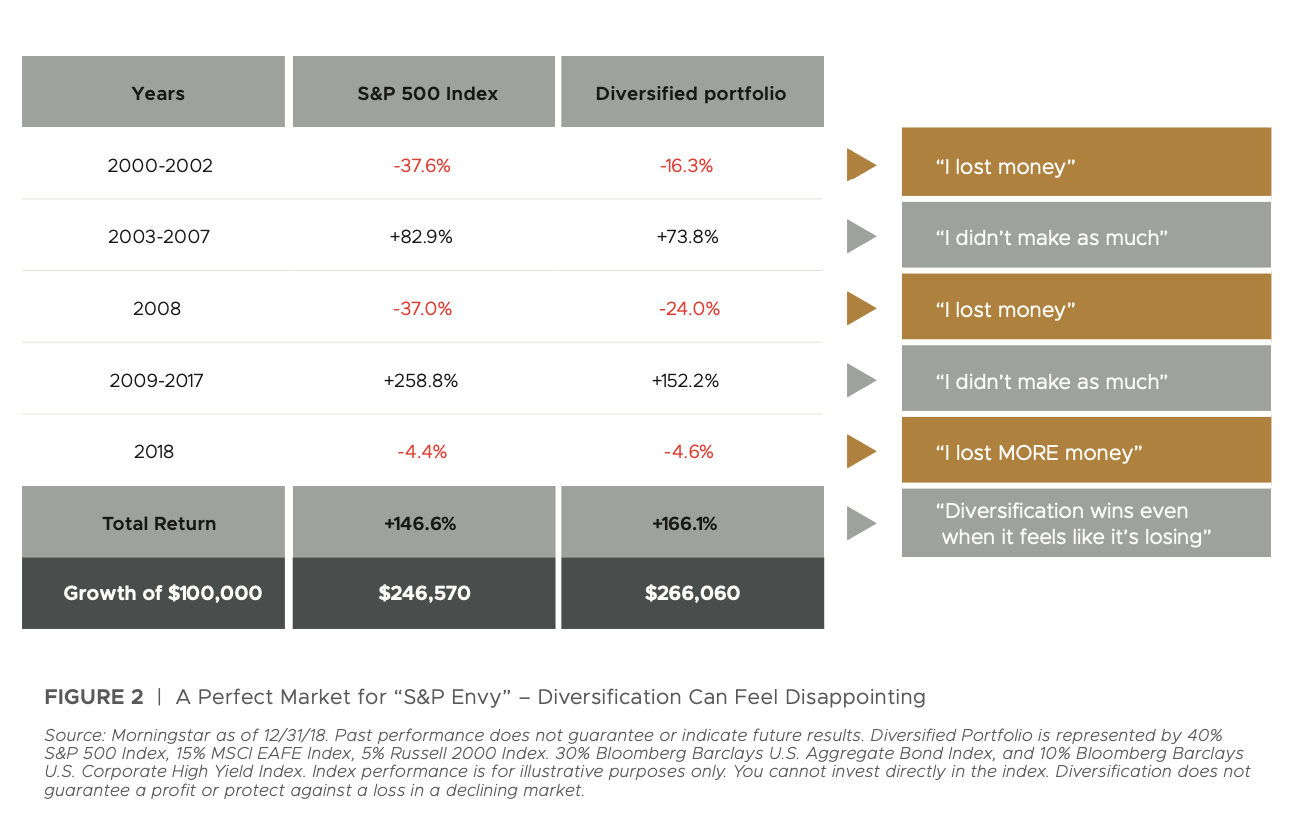

Diversification is one of our most powerful tools to mitigate volatility. Diversification can feel disappointing since you are not getting the highest highs and you do still lose when the market goes down. However, review this chart that compares a 60/40 diversified portfolio to the S&P 500. It is easy to see how one could get caught up in feeling left behind when, in reality, you are ahead!

Volatility is Natural

If only we could count on the stock market going up exactly 10% every year, we would all simply buy an S&P 500 index fund and never think about it again. Of course, if this were the case, what would they talk about on the news? Unfortunately, for all of us, this type of steady market growth does not happen every year. Even though volatility is a part of investing, this does not mean that we have to like it. You may have wondered, “What is my Owen Legacy Group advisor doing to mitigate all of the volatility I hear about?” We actively work to reduce the volatility in your portfolio in many ways, including diversification, correct asset allocation for your goals, rebalancing, active management, and cash management, to name a few. If you want to know more about how your portfolio is positioned to withstand a recession, give us a call and we can talk you through the finer points for your specific situation.

When is Volatility Helpful?

Volatility is helpful when you are trying to accumulate wealth. If you have a long time horizon (10+ years) and are contributing to your investment accounts, volatility will offer you an opportunity to buy more with less. So, if you are more than 10 years from wanting to spend the money in your accounts, your mantra should be, “BRING ON THE VOLATILITY.”

When is Volatility Harmful?

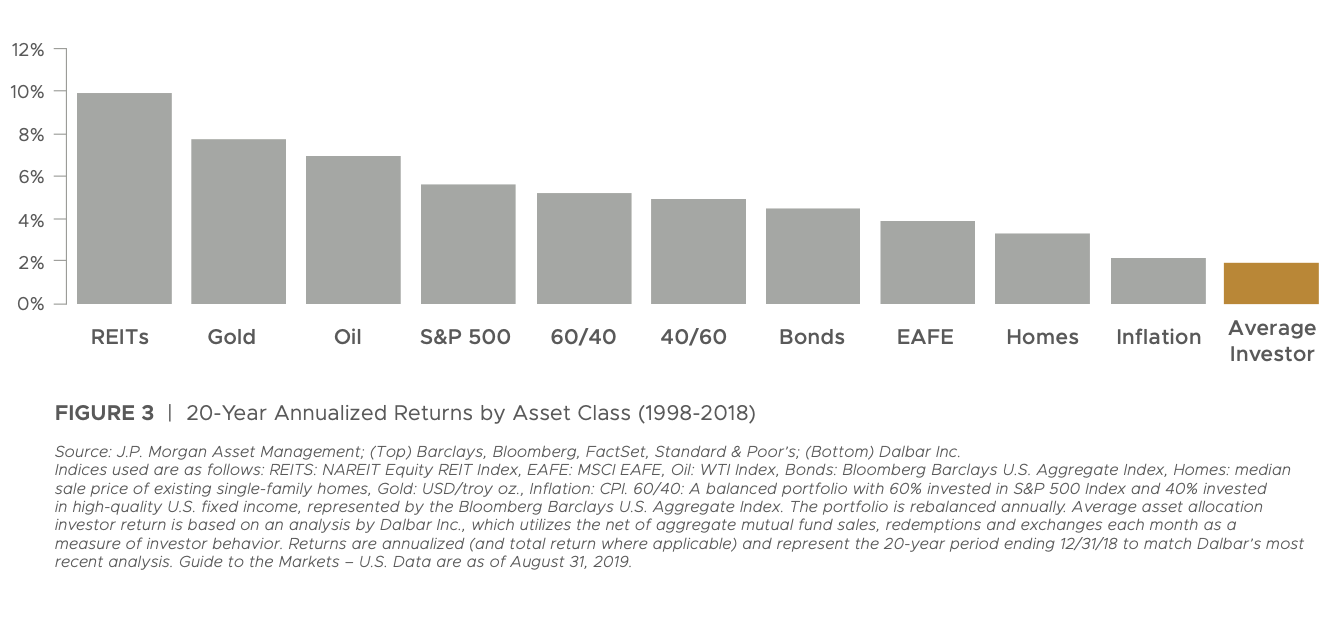

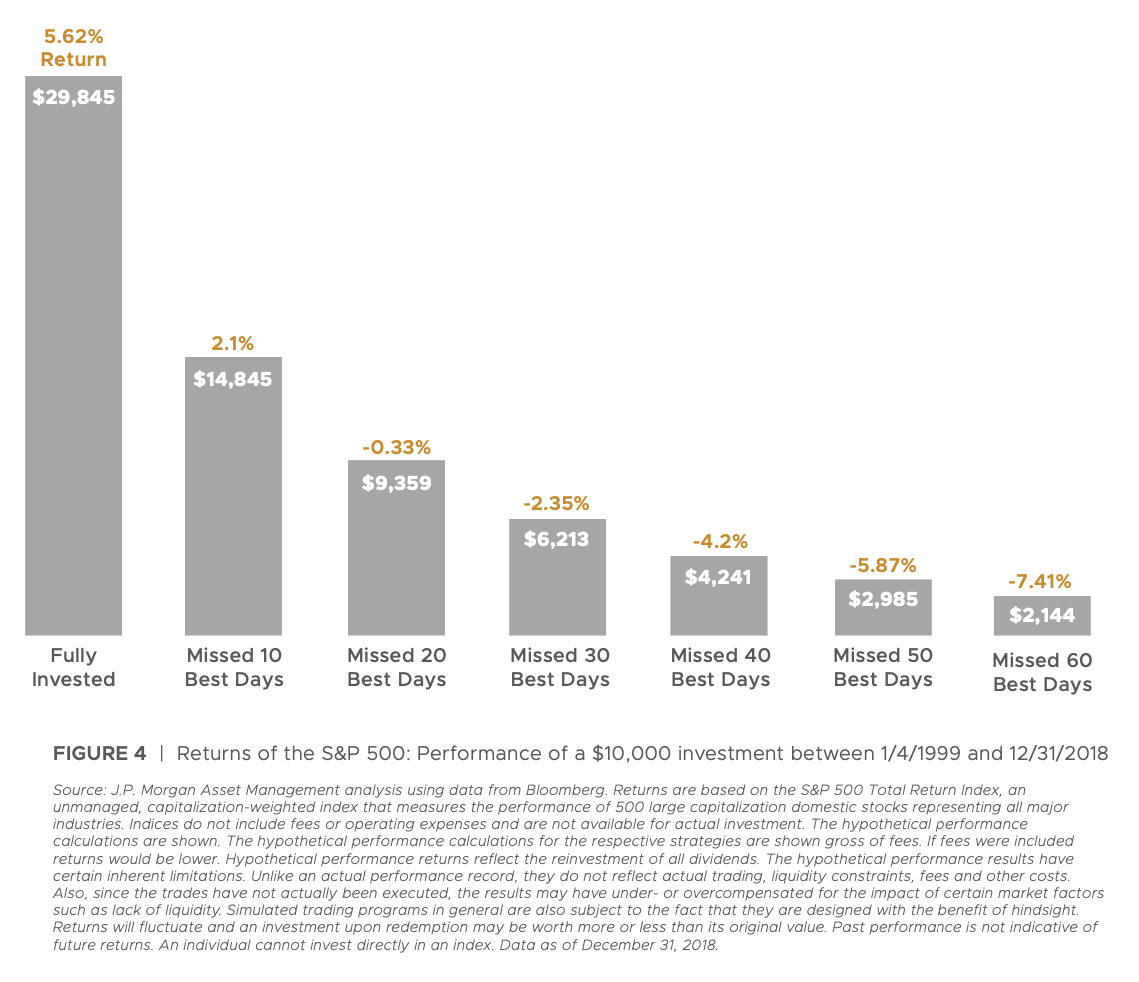

Volatility is harmful when you have a very short time horizon. If you need a large portion of your account in the next 6-18, even 24 months, we want to know about it. That way we can take appropriate action to protect your portfolio from the short-term ups and downs of the market. Another way that volatility is harmful is it creates uncertainty and fear. One of the worst things you can do in a volatile market is “cash out.” This is dramatically visualized in the following charts (Figures 3 and 4*).

In Figure 3, you can see that the “average investor” is the worst performing asset class coming in below inflation. These people are not working with a different market than the rest of us. What they don’t have is someone telling them not to cash out, or not to buy the hot new stock their neighbor told them about. In fact, you can see in Figure 4* that if you are out of the market for just 10 of the best days of the year, your total return for the year is less than half of what it would have been if you had stayed invested.

What If I Could Get Out Right Before The Market Crashes?

Wouldn’t it be nice to have a crystal ball and be able to time the perfect day to exit and then re- enter the market? The truth is that no one has a crystal ball. There are people who discuss timing the next crash with fervent confidence, but the best, brightest, and most successful are much more careful and humble. The trick is not to time the market but to let your assets have time in the market. The more time you have to invest, the less you should care about the ups and downs. This is why in our reviews one of the first things we ask is, “Do you have any immediate cash needs?” If we can accurately manage your short- and long-term goals, we can be more successful in achieving both of them.

How Do I Know if I'm in the Right Portfolio?

- Know where you stand. What is your asset allocation? How much would your account have been down in 2008? If this knowledge keeps you up at night, let your advisor know so that we can adjust your asset allocation accordingly.

- If you are worried, talk to us. We are here to walk you through your financial plan and help you know what to expect.

- Call your Owen Legacy Group advisor and let us know if you have any cash needs in the next 6-18 months.

- When you have decided on a portfolio and determined it is the right place for you and your goals, stick to it. When the market is down 20%, it is not usually a good time to make wholesale changes to your portfolio. It is the people who stick with their plan that win out in the end.