BUDGETING FOR INFLATION: WHERE TO CUT BACK

Now is the time to take a hard look at your budget. Hopefully, cutting non-essentials can help you free up needed cash to cover the rising costs of essentials while still being able to put money into emergency and retirement savings.

CUT DISCRETIONARY SPENDING

While cutting back on discretionary spending is never easy, it might be the only way to make your budget work during these inflationary times. Consider the following:

• Limit dining out to special occasions.

• Skip this year’s travel but start planning next year’s vacation, or look for more budget-friendly alternatives. Studies show that planning a trip can be as enjoyable as taking one.2

• Only buy essential wardrobe items and limit purchases to resale shops and sales racks.

• Cut any subscription service you can do without right now, from streaming services to gym memberships.

Remember that these cuts are temporary and that by cutting back now, you’ll be in better financial shape to spend on these things once inflation levels off or your income catches up.

REDUCE ESSENTIAL COSTS

If your budget is still tight after trimming discretionary expenses, look for ways to reduce essential costs. Even with rising prices, food and gas are two areas where you can likely find ways to save.

You might not be able to trim a lot from your budget essentials, but several minor cuts can add up and allow you to continue putting money into savings.

DON’T STOP SAVING

Your emergency fund and retirement savings should be the last places to make cuts.

If you’ve had to dip into your emergency fund, start building it back up as soon as possible. It can help you avoid taking on credit card debt if an unexpected expense does arise.

During the pandemic, 27% of survey respondents did not pause or reduce retirement savings contributions. While only 14% of individuals were unsure when they would resume their contributions to their pre-pandemic contribution rate, many people have fallen behind on savings goals.

We’re facing inflation now, but things certainly will cost more 10, 20, or 30 years from now when you’re tapping into retirement savings. Continuing to invest in the present can help you cover those future higher costs and combat inflation.

If it feels like inflation is derailing your financial goals, work with your financial professional to revisit your objectives and adjust your budget.

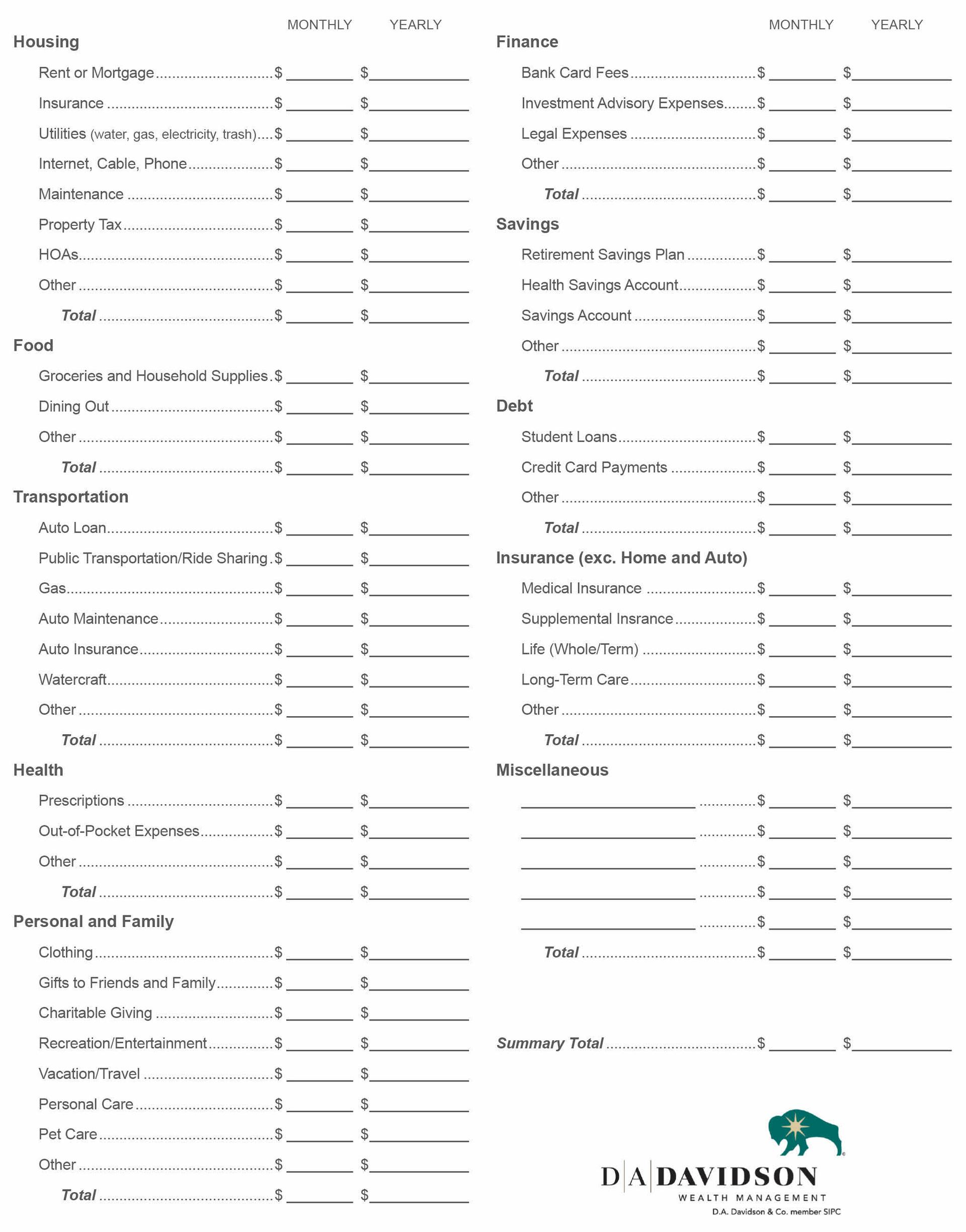

SPENDING PLAN

1D.A. Davidson National Wealth Survey

2 How Trip Planning and Happiness Are Directly Correlated

This material is being provided for educational and informational purposes only. D.A. Davidson & Co. is a registered broker-dealer and registered investment adviser that does not provide tax or legal advice. Information contained herein has been obtained by sources we consider reliable, but is not guaranteed and we are not soliciting any action based upon it. Any opinions expressed are based on our interpretation of the data available to us at the time of the original article. These opinions are subject to change at any time without notice. Copyright D.A. Davidson & Co., 2022. All rights reserved. Member FINRA and SIPC.