First Quarter 2019 Investment Commentary

2019 Q1 Edition

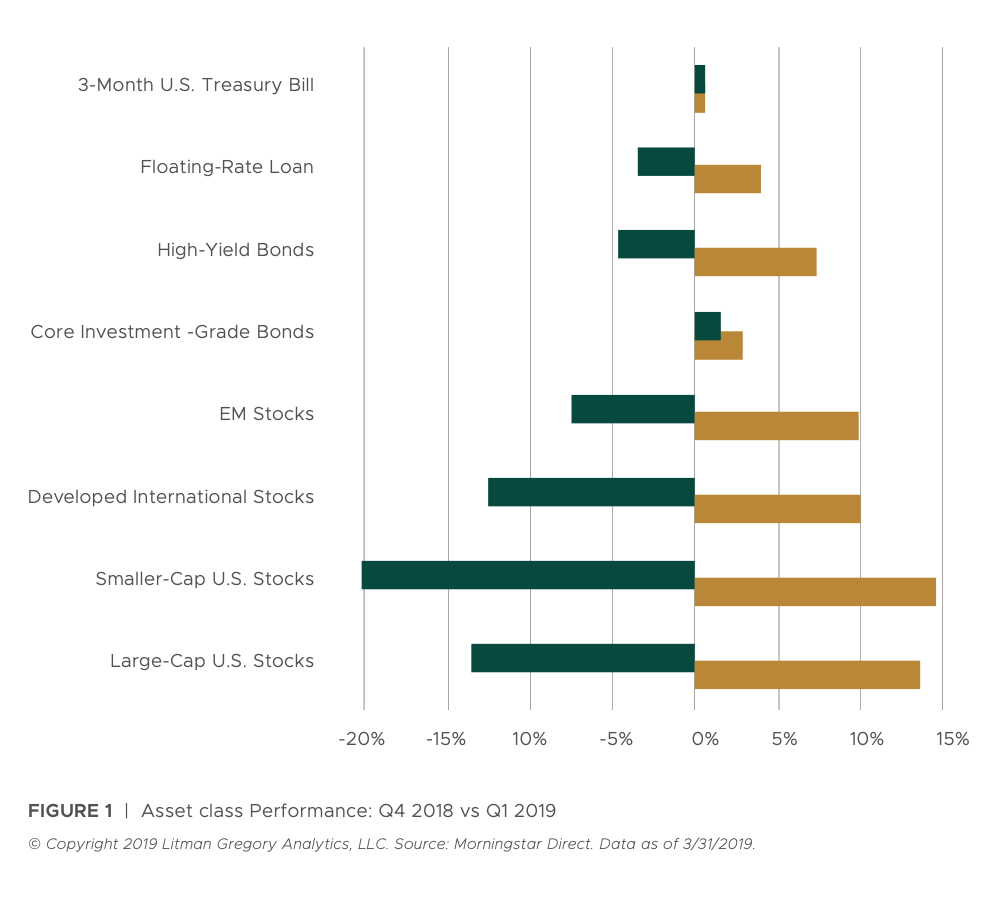

After posting their worst December since 1931, U.S. stocks surged to their best January since 1987, followed by further gains in February and March. Once again, the markets surprised the consensus and demonstrated the folly of trying to predict short-term performance. Investors who bailed out of stocks during the year-end selloff experienced severe whipsaw as the market rallied. Larger-cap U.S. stocks gained 13.6% for the quarter, placing it in the top decile of quarterly market returns since 1950. As a reminder, last year’s fourth quarter 14% drop was a bottom-decile dweller.

Foreign stocks also rebounded sharply in the first quarter. Developed international markets gained 10.6% and European stocks were up 10.9%. Emerging-market (EM) stocks rose 11.8%, after holding up much better than U.S. stocks on the downside in the fourth quarter of 2018.

Fixed-income markets were also strong: High-yield bonds gained 7.4%, floating-rate loans were up 4%, and investment-grade bonds rose 2.9%. The 10-year Treasury yield fell to 2.39% during March, its lowest level since December 2017. Our tactical positions in actively managed flexible income funds also generated strong returns. They outperformed the benchmark core bond index as a group this quarter.

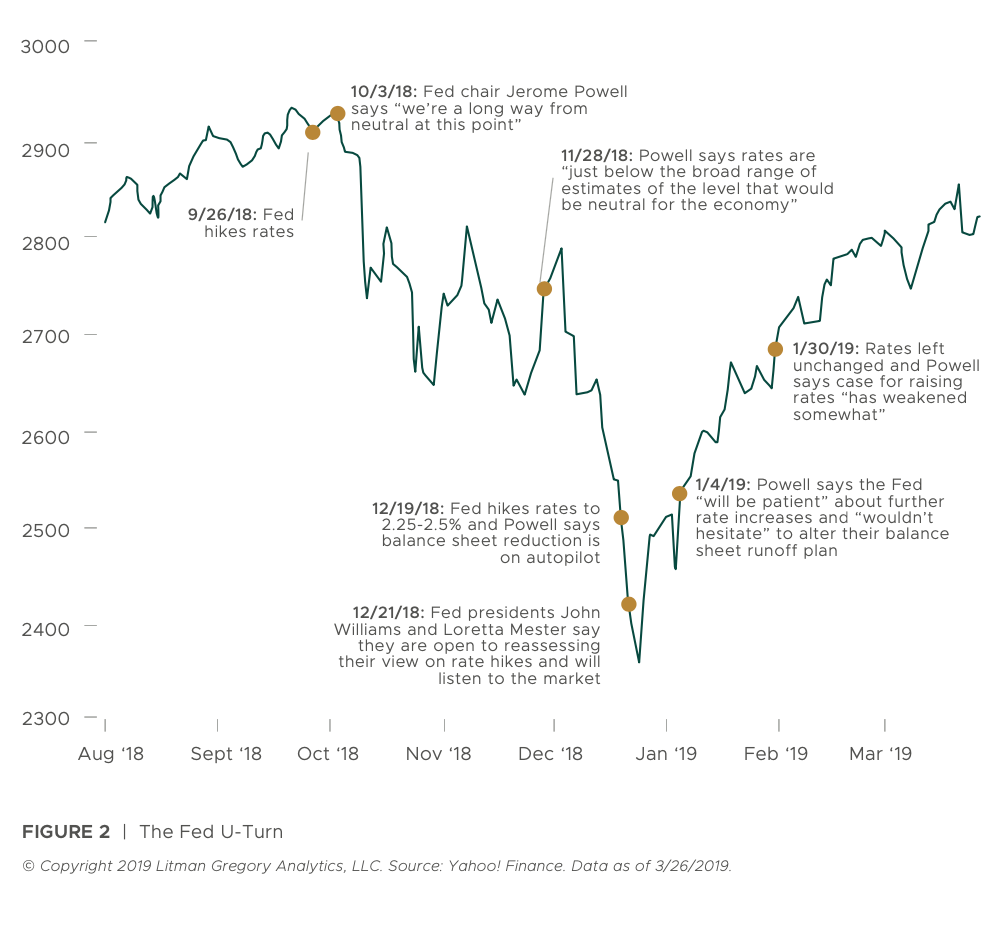

The market rebound was predominately due to a U-turn in Federal Reserve monetary policy. After hiking interest rates four times in 2018, Fed officials suddenly reversed course. They emphasized they would be “patient” and pause any further rate increases. Admittedly, there were other positives for the markets as well: The federal government shutdown ended in late January, signals from the U.S.-China trade talks turned more positive, and the likelihood of a “hard Brexit” seemed to wane.

It certainly feels better to see strongly positive portfolio performance this quarter compared to the losses in the fourth quarter of 2018. But just as we wouldn’t extrapolate last year’s losses when looking out over the coming years, it’s equally important to temper our expectations on the upside after this quarter’s strong rebound.

If monetary and fiscal stimulus around the globe extend the cycle for another few years, we have exposure to a wide range of investments that will particularly benefit. These include global equities, with an emphasis on developed international, European, and emerging-market stocks; flexible income funds; and floating-rate loan funds.

On the other hand, if a recessionary bear market strikes, our holdings in core bonds should perform well. And we would then be in position to tactically add back to riskier asset classes, such as U.S. stocks, at lower prices and higher prospective medium-term returns.

Market Recap

On the heels of their worst December since 1931, U.S. stocks opened 2019 by scoring their best quarter since the financial crisis. Larger-cap U.S. stocks gained 13.6%, placing the S&P 500 Index’s performance in the top decile of quarterly market returns since 1950. Not to be left behind, foreign equities, which were by far the most battered coming out of 2018, generated double-digit returns: emerging-market stocks rose 11.8%, while developed international stocks gained 10.6% and European equities gained 10.9%.

Fixed-income markets were also strongly positive. High-yield bonds earned 7.4% in the first quarter, floating-rate loans were up 4%, and the core investment-grade bond index returned 2.9%. The 10-year Treasury yield fell to 2.39% during March, its lowest level since December 2017, after peaking at 3.24% late last year.

The market rebound was predominately due to a U-turn in Fed monetary policy. After hiking interest rates four times in 2018, including at their mid-December meeting, and indicating further tightening would occur in 2019, Fed officials suddenly reversed course. They emphasized they would be “patient” and pause any further rate increases. And—presto!— stocks are back at their highs of late last summer.

Admittedly, there were other positives for the markets as well: The federal government shutdown, which had started to weigh on sentiment, ended in late January; signals from the U.S.-China trade talks turned more positive; and the likelihood of a “hard Brexit” also seemed to wane.

Portfolio Attribution

Our portfolios generated strong performance for the first quarter, largely driven by their exposure to U.S., international, and emerging-market stocks. Our actively managed domestic, international, and global stock funds also added value, as in aggregate they outperformed the benchmark indexes for the period.

Our tactical positions in actively managed flexible income and floating-rate loan funds also generated strong returns and outperformed the benchmark core bond index in aggregate.

Market Outlook

The obvious question after experiencing such a rebound is, what’s next? It’s easy to be enamored with the U.S. equity market, especially when the Fed is playing its cards face up. However, the reality is the market rebound was due more to improving investor sentiment and risk appetite—caused largely by the shift in Fed monetary policy—than any meaningful improvements in underlying economic or business fundamentals.

From our vantage point, looking out over our longer-term investment horizon, seemingly little has changed after the roller coaster ride of the last six months. The first quarter of 2019 was certainly a nice respite from the losses of 2018, but we remain prepared for renewed market choppiness as the economic cycle gets later and later (and closer and closer to the inevitable downturn).

While the U.S. economy is still arguably the strongest market, growth expectations have been coming down. At its Federal Open Market Committee meeting on March 20, the Fed downgraded its median GDP growth estimate to just 2.1% for 2019 and 1.9% for 2020, citing the effects of economic slowdowns in China and Europe, fading stimulus from the 2017 Trump tax cuts, and ongoing uncertainty around Brexit and trade policy.

U.S. corporate earnings growth expectations also continue to decline. Consensus earnings-per- share growth estimates for the S&P 500 have dropped from 12% (as of 12/31/18) to just 4.1% as of mid-March. Even with the Fed now on hold, earnings growth will need to improve for stocks to appreciate meaningfully from current levels, given their sharp rebound in the first quarter and high valuations. Our annualized return expectations for U.S. stocks are in the low-single- digit range over the next five years.

On the other hand, there are a number of short-term scenarios that could see further equity gains, in particular in foreign markets. The Chinese government is once again trying to boost their economy via fiscal and monetary policy (including tax cuts, lower interest rates, and expanded bank lending). A revival in Chinese growth would have positive ripple effects across the global economy. It would benefit other emerging markets and Europe in particular, as China is a major importer of their goods. This foreign stimulus, combined with the Fed’s policy U-turn, may enable equity markets to extend their positive run for another few years. This outcome would certainly benefit our portfolio positions in developed international and emerging markets, among other riskier assets.

While we’d prefer to see global growth rebound with continued strong performance, we believe it is wise to be prepared (mentally, emotionally, and financially) for shorter-term downside and negative market surprises. If and when a recessionary bear market strikes, we will look to our holdings in core bonds to provide ballast to our portfolios and limit the impact of equity declines.

Any prolonged downturn will also likely present us with opportunities to tactically increase our exposure to riskier asset classes, such as U.S. stocks, at lower prices and higher prospective returns.

As always, we appreciate your trust and confidence in our investment discipline, and we work hard every day to continue to earn it.

— The Owen Legacy Group

The Market Commentary & Portfolio Strategy is mailed quarterly to our clients and friends to share some of our more interesting views. Certain material in this work is proprietary to and copyrighted by Litman/Gregory Analytics and is used by Owen Legacy Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.