Third Quarter 2021 Investment Commentary

2021 Q3 Edition

Market Recap

A September slump put a pause on the global equity bull market. The S&P 500 Index dropped 4.7% for the month, developed international equities (MSCI EAFE Index) fell 2.9%, and emerging-market (EM) stocks (MSCI EM Index) dropped 4.0%. For the third quarter, the S&P 500 was up just 0.6%, MSCI EAFE was down 0.4%, and EM stocks declined 8.1%. For the year to date, the S&P 500 is up an impressive 15.9%, MSCI EAFE is up 8.3%, and the MSCI EM Index is down 1.2%.

The culprit behind emerging-market stocks’ poor recent showing is China (more on this below). The MSCI China Index was by far the worst-performing stock market in the third quarter, down 18.2%. For the year to date it is down 16.7%. Chinese stocks comprise roughly 35% of the EM equity index.

Meanwhile, within the broad U.S. market, smaller-company stocks and growth stocks beat value stocks for the second straight quarter, with sector performances reflecting a somewhat more risk-averse investor mindset, consistent with the COVID-19-related economic growth slowdown during the quarter.

In the bond markets, core bond returns were essentially flat and yields were little changed for the quarter. But it was a roller-coaster ride, with the 10-year Treasury yield plunging below 1.2% in early August, and then shooting back up in the last two weeks of September. Credit-sensitive bond segments outperformed core bonds, and for the year to date, core bonds are now down 1.6%, while high-yield bonds and floating-rate loans are up 4.6% and 4.4%, respectively.

Investment Outlook

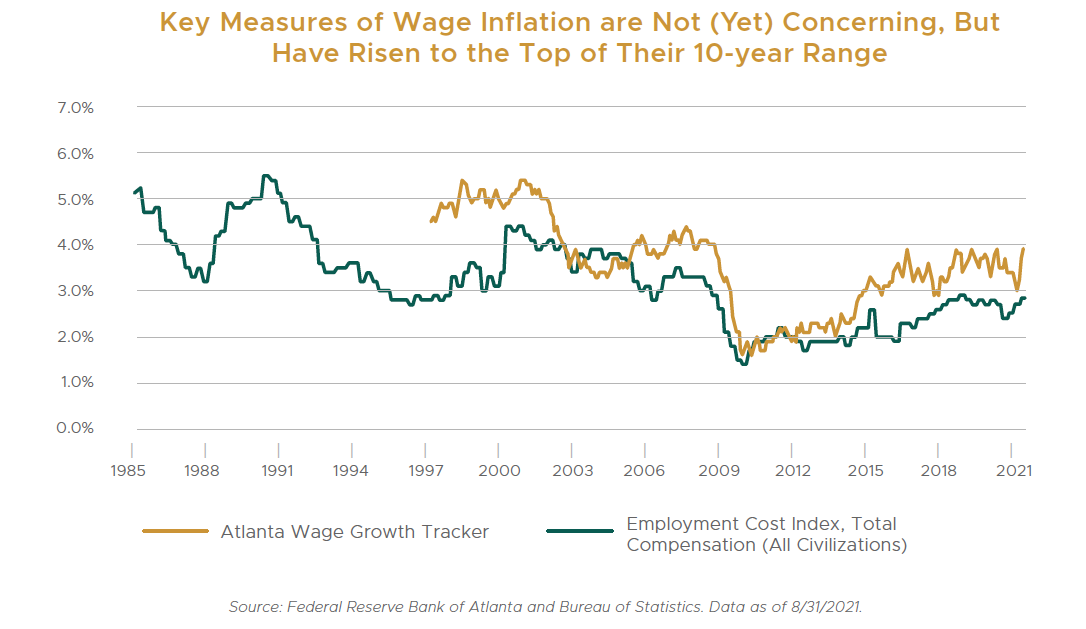

Last quarter we summarized our view that higher inflation is more likely a transitory effect of COVID-19 and supply-chain disruptions versus the start of a new regime where higher wages and inflation create a damaging inflationary spiral. We do expect modestly higher inflation in the years ahead but it is not a significant concern.

In all, we are satisfied that our portfolio positioning, which includes allocations away from core bonds in favor of flexible credit strategies, is appropriate for a return to more historically normal levels of inflation in the years ahead. We will continue to monitor inflation closely and adjust our views and positioning as needed.

A new concern that emerged in the third quarter is around the excessive borrowing in China’s property sector and within Evergrande Group, one of the country’s largest property developers. Moreover, this has come amidst other regulatory crackdowns in China (such as in the for-profit education industry).

We have followed these events closely as part of our ongoing research on China and emerging markets. Thus far we are of the view that these risks will be contained, and therefore we are not currently contemplating any changes to our portfolio positioning. Looking further ahead, the short-term pain could result in new opportunities for investors in China.

We take higher risk into account when assessing the relative attractiveness of emerging markets by requiring a significantly higher extra return (return premium) than we would for a less volatile asset class. Risks particular to China are explicitly factored into our return requirement, including haircutting long-term growth assumptions until there is more clarity on the rules of engagement for regulation and on credit conditions in China.

We remain comfortable with our current emerging-markets allocation after taking into account the risks we see in China along with the diversification benefits and long-term return potential it brings. Ultimately, the reality in investing is that information like the problems facing Evergrande is quickly priced in (and more often over-priced in). So the question is whether this is a shorter-term disruption or whether it is revealing a more fundamental long-term change that deserves to impact our long-term risk and return assumptions. This question is the focus of our analysis.

We remain comfortable with our current emerging-markets allocation after taking into account the risks we see in China along with the diversification benefits and long-term return potential it brings. Ultimately, the reality in investing is that information like the problems facing Evergrande is quickly priced in (and more often over-priced in). So the question is whether this is a shorter-term disruption or whether it is revealing a more fundamental long-term change that deserves to impact our long-term risk and return assumptions. This question is the focus of our analysis.

A catalyst for the Evergrande-related turmoil is the Chinese government’s steps to rein in speculation that they believe is leading housing to become increasingly unaffordable, which is contrary to their long-term sustainability goals, such as reducing inequality. This in turn is surfacing issues related to excessive leverage in the property sector that have built over many years. We are focused on understanding how large the problem is and whether China will manage this adjustment well.

6

At present, we share the widely held view that a Lehman-like disruption locally in China or globally is unlikely. (The 2008 collapse of Lehman Brothers set off a negative chain reaction in the financial sector.) For one, we don’t see the same feedback loop between China’s property sector and the global economy. In addition, Chinese citizens have a lot of wealth tied up in property, so it is in the government’s interest to avoid a chaotic wave of defaults and the government has the means to stabilize the financial system since it is the majority owner. A more orderly restructuring still seems the more likely scenario.

It is also the case that a lot of bearish sentiment has been priced into emerging-market stocks; in fact, some of our managers are seeing potential long-term return opportunities emerge in China. That said, we will continue with our analysis and if we conclude the impact is likely to be long term versus temporary, we will factor that into our portfolio positioning.

Closing Thoughts

Our base case for the next several years remains relatively sanguine, as we expect the economic and earnings growth cycle, interest rates, and government policy to remain broadly supportive of equities and other risk-asset markets. However, our analysis also suggests we should be prepared for an extended period of lower absolute investment returns—certainly, in our base case, much lower for U.S. stock and core bond market indexes than the last five to 10 years. (The S&P 500 has gained 17% annualized over the past 10 years and core bonds are up 3% annualized.)

Absent significant further U.S. equity valuation expansion (higher price-to-earnings multiples), from already near-record-high levels, double-digit U.S. market annualized returns are extremely unlikely. Record-low bond yields and above-trend earnings growth (driven by mega-cap tech/internet leaders) have driven strong returns but mathematically and economically, that is extremely unlikely, if not impossible, to repeat over the next five to 10 years, given where we are now starting from in terms of yields, profit margins, and earnings growth.

Nevertheless, in our medium-term “upside” scenario, we estimate still-attractive upper-single-digit returns for U.S. stocks. And in our base case, while their absolute returns are uninspiring, we expect U.S. stock returns to be attractive relative to core bonds.

Meanwhile, expected returns for non-U.S. equities—EM equities in particular—remain attractive, which is the primary reason for our tactical overweight to them. But as we experienced with EM stocks in the third quarter, equity investors should be prepared for a bumpy ride.

As always, we thank you for your trust, and we welcome questions you may have about the investment landscape or your portfolio.

–The Owen Legacy Group

Certain material in this work is proprietary to Litman Gregory Analytics and is used by Owen Legacy Group with permission. Reproduction or distribution of this material is prohibited and all rights reserved.

7